Health insurance coverage is one of the most important topics for individuals and families seeking financial security and access to quality healthcare. Yet, many people purchase health insurance without fully understanding what is covered, what is excluded, and how benefits actually work.

This complete beginner’s guide explains health insurance coverage in simple terms. Whether you live in the United States, Canada, the United Kingdom, Australia, or another Tier-1 country, understanding your coverage helps you avoid unexpected medical bills and make smarter financial decisions.

What Is Health Insurance Coverage?

Health insurance coverage refers to the range of medical services and expenses that an insurance provider agrees to pay for under your policy. Coverage determines how much of your healthcare costs are paid by the insurer and how much you must pay out of pocket.

Comprehensive plans typically include preventive care, hospital services, prescription medications, emergency treatment, and specialist consultations. However, exact benefits vary depending on your specific plan and provider.

Why Understanding Health Insurance Coverage Matters

Many people assume that having health insurance means all medical expenses are covered—but this is not always true. Policies include exclusions, deductibles, and cost-sharing rules.

- Avoid surprise medical bills

- Choose the right healthcare providers

- Plan for out-of-pocket expenses

- Maximize insurance benefits

- Protect long-term financial stability

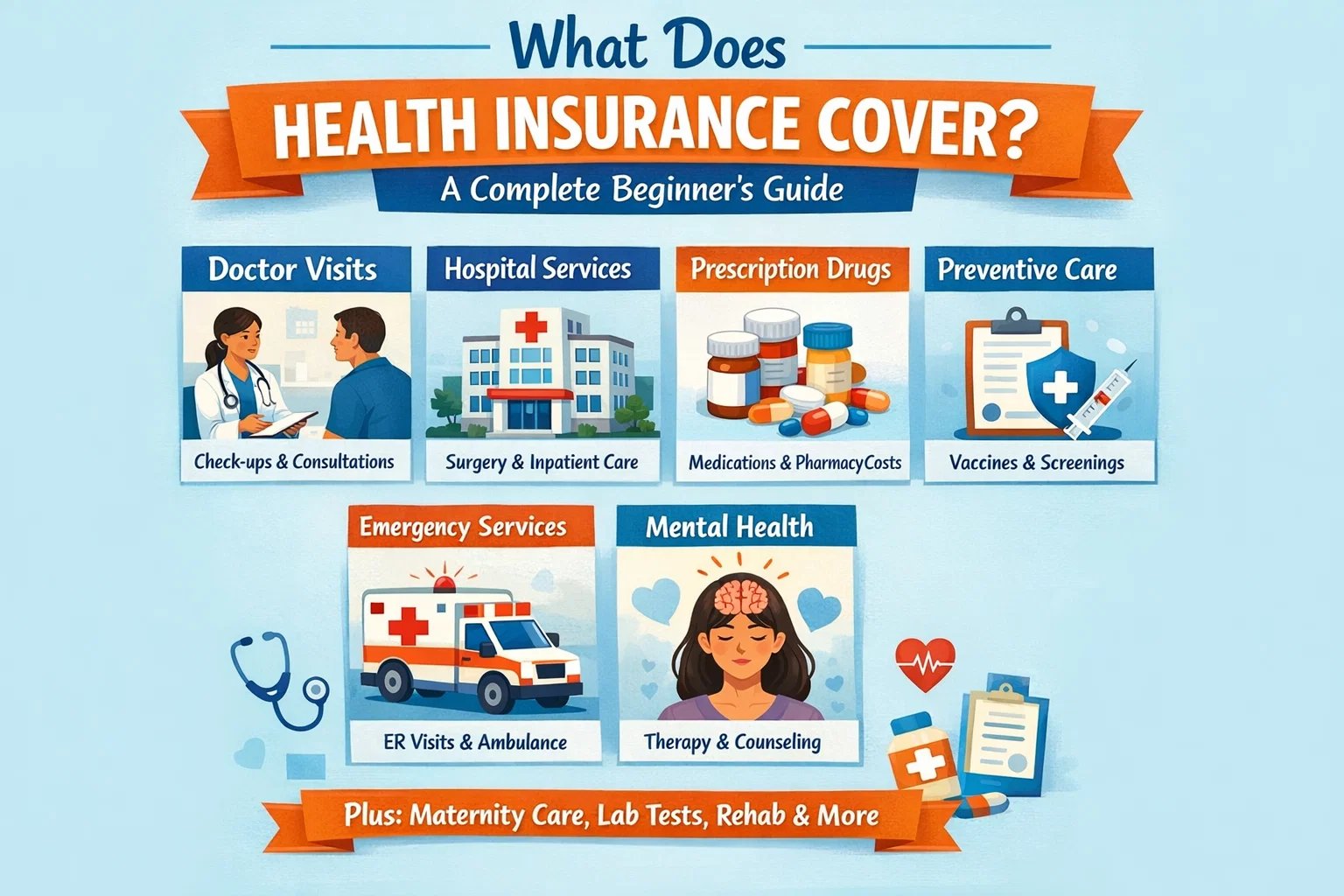

Core Benefits Included in Most Health Insurance Plans

| Coverage Area | What It Includes |

|---|---|

| Doctor Visits | Primary care, specialists, and follow-ups |

| Hospitalization | Surgeries, inpatient care, and nursing services |

| Emergency Services | ER visits, urgent care, and ambulance services |

| Prescription Drugs | Approved medications under the plan formulary |

| Preventive Care | Vaccinations, screenings, and annual checkups |

Preventive Care Coverage

Preventive care is one of the most valuable insurance benefits. Many Tier-1 country plans cover routine exams, blood tests, cancer screenings, immunizations, and wellness counseling at little or no extra cost.

Early detection reduces long-term treatment expenses and improves overall health outcomes.

Hospital and Surgical Coverage

Hospitalization is among the most expensive healthcare services. Insurance typically covers hospital stays, surgeries, ICU care, and recovery services.

Choosing in-network hospitals usually results in significantly lower costs compared to out-of-network facilities.

Prescription Drug Coverage

Most plans include prescription drug benefits, though coverage depends on the insurer’s medication tiers. Lower-tier drugs cost less, while specialty medications may require higher copays.

Mental Health and Wellness Coverage

Modern health insurance increasingly includes therapy, counseling, and mental health evaluations. This support is especially valuable in countries where mental healthcare can otherwise be expensive.

What Is Typically Not Covered?

- Cosmetic or elective procedures

- Non-medically necessary treatments

- Experimental or unapproved therapies

- Out-of-network services (in some plans)

- Limited waiting periods for certain conditions

Understanding Deductibles, Copays, and Coinsurance

Even when services are covered, you may share costs:

- Deductible: Amount paid before coverage begins.

- Copay: Fixed fee for specific services.

- Coinsurance: Percentage of shared medical costs.

Coverage Differences Between Plan Types

- HMO: Lower cost, limited provider network

- PPO: Higher flexibility, higher premiums

- EPO: No out-of-network coverage except emergencies

- High-Deductible Plans: Lower premiums, higher upfront costs

How to Check Your Health Insurance Coverage

Review your policy’s summary of benefits, exclusions, provider network, and claims process. Contacting your insurer directly can clarify coverage details and prevent misunderstandings.

Choosing the Right Coverage for Your Needs

Selecting the right plan requires balancing affordability with protection. Consider medical history, lifestyle, and expected healthcare needs to ensure long-term security.

Health Insurance Coverage and Financial Protection

Medical expenses are a leading cause of financial stress in Tier-1 countries. Comprehensive health insurance acts as a financial safety net, protecting savings while ensuring access to quality healthcare.

Final Thoughts

Understanding what health insurance covers is essential for informed decision-making. From preventive services and hospitalization to prescriptions and mental health support, coverage protects both your health and finances.

By carefully reviewing policy details and selecting the right plan, individuals and families can achieve long-term security and reliable access to care when it matters most.