Life insurance is one of the most important financial tools you can own, yet it is often misunderstood or postponed. In 2026, with rising living costs, higher debt levels, and increasing financial responsibilities, life insurance is no longer optional—it is essential.

This comprehensive guide explains life insurance basics in simple language, helping you understand how life insurance works, why it matters, and how to choose the right policy to protect your family’s financial future.

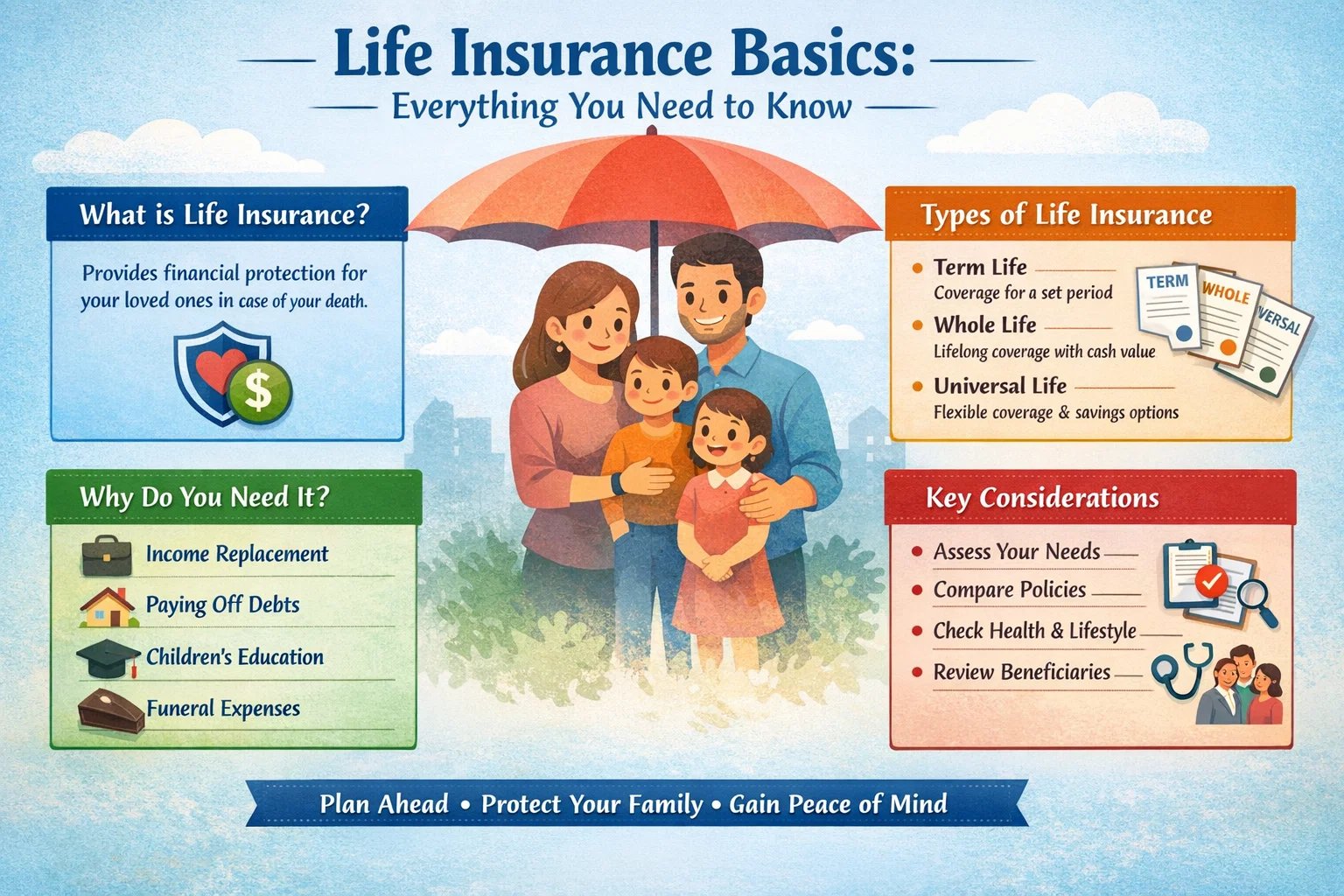

What Is Life Insurance?

Life insurance is a legal contract between you and an insurance company. In exchange for regular premium payments, the insurer promises to pay a lump-sum amount—called the death benefit—to your beneficiaries if you pass away during the policy term.

The primary purpose of life insurance is financial protection. It ensures that your loved ones can maintain their lifestyle, pay debts, and cover essential expenses even in your absence.

Why Life Insurance Is Important in 2026

- Rising household debt and mortgages

- High education and healthcare costs

- Single-income or dual-income dependency

- Longer life expectancy

A well-structured life insurance policy provides long-term security and peace of mind, especially in Tier-1 countries such as the United States, Canada, the UK, and Australia.

How Does Life Insurance Work?

- You choose a policy type and coverage amount.

- You pay premiums monthly, quarterly, or annually.

- If the insured person passes away, beneficiaries file a claim.

- The insurer verifies the claim and pays the death benefit.

Some policies also include savings, investment, or cash-value components that grow over time.

Main Types of Life Insurance

Term Life Insurance

- Coverage for a fixed period (10, 20, or 30 years)

- Lower premiums

- Pure financial protection with no maturity value

Best for: Income replacement and debt protection.

Whole Life Insurance

- Lifetime coverage

- Guaranteed death benefit

- Cash value accumulation

Universal Life Insurance

- Flexible premiums

- Adjustable death benefit

- Investment-linked growth potential

Term vs Whole Life Insurance: Key Differences

| Feature | Term Life | Whole Life |

|---|---|---|

| Coverage Period | Fixed term | Lifetime |

| Premium | Lower | Higher |

| Cash Value | No | Yes |

| Best For | Income protection | Wealth planning |

Who Needs Life Insurance?

- Married individuals

- Parents with dependent children

- Homeowners with mortgages

- Business owners

- People with outstanding loans

Even single individuals may benefit from life insurance for debt coverage and estate planning.

How Much Coverage Do You Need?

Financial experts commonly recommend coverage equal to:

- 10–15× annual income

- All outstanding loans and mortgages

- Children’s future education costs

- Long-term living expenses for dependents

Proper coverage ensures long-term financial stability for your family.

Understanding Life Insurance Premiums

Premiums are influenced by:

- Age

- Health condition

- Lifestyle habits (smoking, alcohol, etc.)

- Policy type and coverage amount

Younger and healthier individuals typically receive significantly lower premium rates.

Life Insurance Riders and Add-Ons

- Accidental death benefit rider

- Critical illness rider

- Waiver of premium rider

- Disability income rider

Riders slightly increase premiums but greatly enhance financial protection.

Tax Benefits of Life Insurance

Many Tier-1 countries provide attractive tax advantages:

- Premiums may qualify for deductions

- Death benefits are often tax-free

- Cash value growth may be tax-deferred

This tax efficiency makes life insurance an important wealth-planning tool.

Common Life Insurance Mistakes to Avoid

- Buying insufficient coverage

- Delaying purchase until older age

- Not disclosing medical history honestly

- Choosing policies based only on price

How to Choose the Right Life Insurance Policy

- Assess financial responsibilities and dependents.

- Select the appropriate policy type.

- Compare insurers and claim settlement ratios.

- Review and update coverage regularly.

Life Insurance and Estate Planning

Life insurance provides liquidity to cover taxes, debts, and asset distribution during estate planning. High-net-worth individuals frequently use life insurance to preserve wealth for future generations.

Final Thoughts

Life insurance is more than just a financial product—it is a long-term promise of protection for the people you love.

In 2026, choosing the right life insurance policy is one of the smartest financial decisions you can make. Start early, choose wisely, and secure your family’s future with confidence.

Life insurance doesn’t just protect lives—it protects legacies.